Pivot and Trading Portfolio Momentum update

- Rogier G. van de Grift

- Jan 3, 2023

- 6 min read

Everything seems frozen at the moment, but there are still changes happening under the radar.

Trading Portfolio; Momentum and China's Pivot

Two years ago now this real money stock portfolio was started in order to beat the S&P 500 index using a proprietary momentum equal weighted method.

In this blog it is time for a relative return evaluation and secondly also some ranting and observations on the state of the stock market.

This blog is for information and entertainment purposes. If the reader uses information in this blog for investment decisions, the reader will lose money. Holland Park Capital London ltd is in no way, shape or form liable for what the reader decides to do after reading this blog.

First things first; on the 1st of July 2020 Q3 the Trading Portfolio; Momentum strategy started with $50000 in investments in S&P 500 index companies.

Now before the open on the 3rd of January 2023 the portfolio is worth $66300. Cash from dividends in the portfolio has not been taken out yet. The value of the cash was about $217. The value of the portfolio stock holdings adjusted for cash is about $66083.

The absolute return of about -13.8% in 2022 was a disaster.

Source Charles Schwab 1 Year Return Trading Momentum; Portfolio 3 Jan 2023

The absolute return of the S&P 500 index was about -19.6% in 2022 was an even bigger disaster.

The MTUM ETF U.S. Equity Factor Momentum was down about -20% in 2022 (Source Seeking Alpha).

The RSP ETF U.S. Equity Factor Equal Weight was down about -13.2% in 2022.

The conclusion stands that the investment strategy seems closer related to the US Equal Weight Factor than the US Momentum Factor.

How has the relative return versus the S&P 500 index fared?

Because if the relative return underperforms, it would have been better to just put the $50000 in an S&P 500 ETF and sit back and relax.

An S&P 500 ETF can be expected to modestly underperform the real S&P 500 index returns, because of the drag of the management costs of the ETF (the expense ratio etc.).

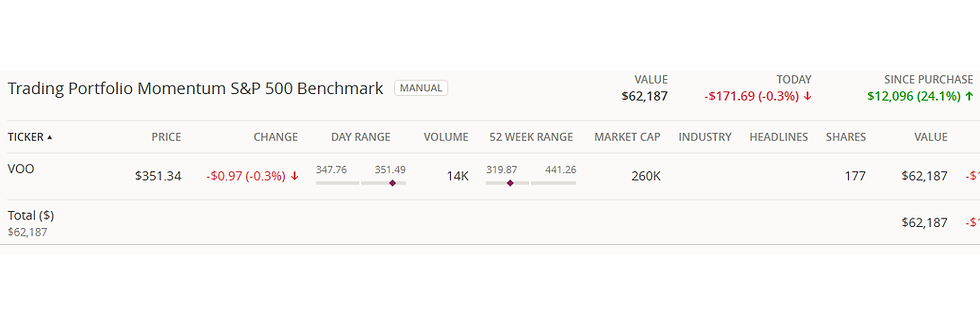

The VOO Vanguard 500 index fund ETF was put in a paper portfolio with two portfolio tracking websites on the 1st of July 2020 with $50000 as well.

On the SigFig website the paper VOO holding would now be worth $62187.

In the Stockrover website the paper VOO etf holding would now be worth $61980.

Above; Sigfig.com VOO ETF value tracked on 3rd of Jan 2023 before the open

So the Trading Portfolio; Momentum outperformed the VOO Vanguard S&P 500 ETF by about 6.26% after two and a halve years (66083/62187 in a percentage). That makes an annual outperformance of about 2.5% versus the VOO S&P 500 ETF.

Two and a have years is still way too short to be able to draw any conclusions with some amount of conviction; time horizons of between five to seven years are needed for that. Still the early conclusion can be that so far the Trading Portfolio; Momentum is worth the time and effort. For Holland Park Capital London for the Trading Portfolio; Momentum to be worth it long term the outperformance needs to be at least 2% a year.

As discussed in the previous momentum blog the US is still in a recession according to Holland Park Capital’s recession definition and so the Trading Portfolio; Momentum did not need a rebalance at the end of Q4 2022. There were only about 2 takeover candidate holdings that needed to be sold and the proceeds were re-invested in the smallest $ value holdings of the existing portfolio.

It is time to move on to the second part of this blog post. Rob Arnott (the founder of Research Affiliates) made a good comment recently on a podcast. He basically said that when you are a long term investor you should think five years ahead and think about the things the mainstream media does not want you to think about.

Following that line of thinking there is plenty to be grateful for that the mainstream media doesn't want you to know.

For one the absolute $ amount of dividends paid by listed stock companies was at a record high in 2022. The VOO ETF now has a dividend yield of about 1.55%. Stockrover predicts the forward looking 2023 dividend yield to be closer to 1.7%.

Also the earnings of the S&P 500 index companies have gone up in 2022. Earnings growth will make the S&P 500 a good long term investment so this is fantastic news.

Of course the P/E ratio of the S&P 500 index has gone down in 2022. So people are willing to pay a lower multiple today for the S&P 500 index earnings compared to this time last year. So the S&P 500 index is now cheaper than 1 year ago. That is good news for the long term return outlook as the cheaper a basket of stocks is, the higher the long term return outlook becomes.

The Fed has already made a pivot in Q4 2022. The Fed has absolutely no idea what they will do with short term interest rates going forward. The Fed will follow the long term changes in the rate of inflation at the moment. In 2023 the previous Fed interest rate hikes will filter into the real economy and inflation may well go negative at the end of 2023. The Fed will probably be slow to lower interest rates as there seems to be an agenda to keep oil prices lower for longer in order not to reward Russia for its actions.

The 30 year U.S. mortgage rates have peaked already. In October 2022 that rate was almost 7.1%. The current 6.42% is already about 10% lower than the high October 30 year mortgage rate. The U.S. long term interest rates are already telling us a story that is becoming less negative and more positive.

Earnings for the S&P 500 index will probably be lower in 2023. Long term though; the S&P 500 index earnings can be counted on the make new record highs. A lot of people have gone out of equities this year and into cash. As and when S&P 500 index earnings start to rise again there will be a wall of money chasing the S&P 500 companies higher.

Nobody is talking about China. China has made a big pivot on the Corona virus though.

Zero Covid doesn't seem to be the Chinese policy anymore. Probably this is not surprising as the head honcho has just secured his third term in power. The end of lockdowns in China in 2023 is bound to send another wave of inflation into the global economy. If the people in China leave their houses again and move more, that will mean increased demand for the likes of coal, iron ore, copper and oil. Long term though China’s factories will compete harder for orders with factories worldwide and that will be deflationary. China’s factories do not care about making profits. It is all one big employment scheme.

In 2024 it could be the first year the world economy is in balance again after all the disruptions caused by how politicians reacted to the Corona virus. So while 2023 can be a tough year the stock market also always looks ahead by 3 to 6 months....

Anyway thanks for reading and good luck! May the force be with you!

The blog is not advice on what you should do with your money and was written for information and entertainment purposes only. When you invest in the stock markets it is possible to lose money. Please do your own research. If in any doubt what is best in your individual situation, please hire a licensed financial advisor. Good luck on your investment journey.

Holland Park Capital London hopes you enjoyed the information in the blog. Holland Park Capital London Ltd is not receiving any compensation from anyone to write this blog. Holland Park Capital London is long most of the stocks in the S&P 500 index and is also long the S&P 500 index ETF. Holland Park Capital London has no business relationship with any company whose stock is mentioned in this blog. Holland Park Capital London expressed its own opinions. This is not advice. Make your own decisions please. Please go and see an authorized financial advisor before making any investment decisions.

What works for Holland Park Capital London may well not work for you and your personal situation is unknown to Holland Park Capital London. Stocks go up as well as down and you may get back less than you invest. Any information in this blog should be considered general information and not relied on as a formal investment recommendation.

This blog is for information purposes only and helps Holland Park Capital London expand on the book “Beat the Stock Market Casino” and brings extra discipline in the investment process. Holland Park Capital London is not liable for any mistakes in this blog. This blog cannot be a substitute for comprehensive investment analysis. Any analysis presented in this blog is illustrative in nature, limited in scope, based on an incomplete set of information and has limitations to its accuracy. The information upon which this blog is based was obtained from sources believed to be reliable, but has not been independently verified. Therefore the accuracy cannot be guaranteed. Any opinions are as of the date of publication and are subject to change without notice.

Comments